About The Event

Whilst women are swaying almost all verticals and sectors across the globe, we are celebrating the insurance industry's foremost women of influence and leadership at the Women in Insurance Tech Conference on September 8 – 9, 2022 | Boston - USA.

With two day precisely designed agenda, the conference will invite the most influential women leaders from the leading insurance companies to enlighten the technological disruption through modes like AI, ML, Big Data & IoT.

Witness the interactive sessions, anecdotal presentations, and engaging panel discussions at this two-day in-person event!

Not trying to Empower Women in Insurance! Rather, we are empowering the insurance world with the influence of women leaders from insurance.

This conference will bring 250+ insurance industry decision-makers together in person, both men, and women, to learn lessons, forge strategies, and tackle the biggest digital transformation challenges encountered by the insurance sectors.

Key Highlights

Women & Leadership in Insurance World | Key Customer Engagement Models | Technological Disruption in Insurance World | Role of AI-ML, Big Data & IoT in the Insurance sector

WHY SHOULD YOU ATTEND

- Hear key strategies for leadership development and exchange of ideas among peers

- New world, new customers, new solutions – Better customer experiences for the foreseeable future

- Digital disruption – Know how you can leverage technologies such as analytics, blockchain and cloud to advantage

- Real-time risk insights by mastering emerging and disruptive technology

- Network with some of the US insurance industry’s most influential women leaders

- Make your presence where leaders and innovators come together

Who Should Attend

The event will witness the perfect blend of leadership across the insurance sector who are looking to gain insights and wish to stay ahead in their digital transformation journey. The attendee mix will observe CIOs, CTOs, CEOs, VP, Directors, Heads, and managers from the insurance domain including:

- Brokers/agents

- Retail agents

- Claim Adjusters

- Underwriters

- Actuaries

C-Level Executives – 16% | Heads, Directors & Presidents – 33% | SVP, VP, EVP & AVP – 15% | Managers & Leads – 29% | Other – 7%

Speakers 2022

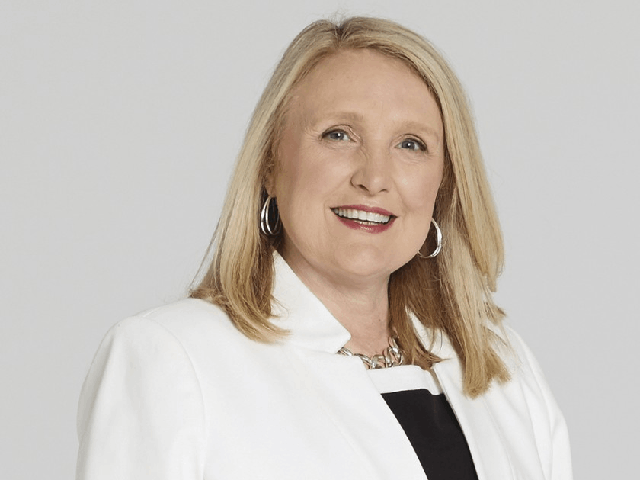

Vinita Jajware-Beatty

President

Toronto Insurance Women's Association (TIWA)

Lori Pon

Director, Claim Transformation

The Auto Club Group

Jennifer Wilson

SVP, National Cyber Claims Lead

HUB International

Michelle Osborne

Michelle Osborne, Associate Professor, Management & Chair of Business Administration,

Campbell University School of Business

Megan Duty

Vice President

Puritan Life

Tracey Sharis

SVP

Ironshore

Gina HardyChief Executive OfficerNorth Carolina Joint Underwriting Association

Lori WeltySenior Product Compliance AttorneyFINEOS

Sue RickardGlobal CTO and innovation leader for InsuranceCognizant

Manisha DiasHead of PartnershipsSCOR

Meredith Barnes-CookVice President of Industry GroupsUshur

Lilit DavtyanCEOPhonexa

Lizzie BronteTechnology Delivery LeaderNationwide

Brittany NevinsCaptive Insurance Economic Development DirectorState of Vermont

Raquel SantanaSVP-Small business and Consumer TechnologyChubb Insurance

Zehra CataltepeCEO & Co-FounderTAZI AI

Kathyn YunDirector, Social Media EnablementNationwide

Kristi DarabanAssociate Vice President, Social MediaNationwide

Bobbie ShrivastavCo-Founder & Chief Product OfficerBenekiva

Laura SalazarQA&T Talent Development and Innovation ManagerSofttek

Sue RubinBusiness Relationship Manager/ Account ManagerSofttek

Danielle GardinerSenior Vice PresidentLowers Forensics International

Paloma Martínez GonzálezQA&V Talent Development & Engagement LeaderSofttek

Kate StillwellFounder and CEOJumpstart Insurance

Bente KrogmannChief Executive Officer and DirectormTek Services

Michaele ClarkClient Relationship DirectorApex Claims Management

Deeksha JoshiVP, GRS Strategy,Liberty Mutual Insurance

Janet MoylanSenior Vice President, North America Underwriting OperationsAllied World Insurance

Susan C. WinklerExecutive Director & Vice PresidentCT IFS, MetroHartford Alliance

Lauren LinkDirector, Strategic Distribution,Kemper Auto

Allison ArzenoCEOAssurance IQ

Katherine WellmanChief Product OfficerCambridge Mobile Telematics

Lakshmi ShaliniVP Risk & Insurance AnalyticsCambridge Mobile Telematics

Dora ClementsVP, Digital Transformation for Benefits, Contact Centers, and Enterprise InitiativesUnum

Georgette E LoizouCEOP&C Insurance System, Inc (PCIS)

Priya RaghunathaSVP, Digital Product Mgmt & Client ExperienceMarsh Mclennan

Sherry HuangChief Actuary and Managing Director - Underwriting DevelopmentNew Energy Risk

Misha Bleymaier-FarrishFounderGSD Factor & Etymology Consulting

Past Event Speakers

Shannon Harjer

Executive Vice President

Producers National Corporation

Michelle Osborne

Chief Deputy Commissioner of Insurance

Carolina Department of Insurance

Meg McKeenFounder & Chief Confidence BuilderAdjunct Advisors LLC

Former Chief Strategic Financial Officer

Farmers Insurance

Theresa Blissing

Founder and Director

the Asia InsurTech Podcast

Michelle M. Lopilato

Director of Cyber & Tech Insurance Solutions

Hub International

Meredith Barnes-CookHead of Global InsuranceUshur

Lilit DavtyanCFO & EVPPhonexa

Erin WilsonEnterprise Business Development ManagerZipwhip

Misha Bleymaier-FarrishFounderEtymology Consulting

Mina SahibFounderWomen's Insurance Network - UAE

Katarzyna MalolepszyVP Technology ProductELEMENT Insurance AG

Lorelei FarrellHead of Product ManagementSlice Labs

Bobbie ShrivastavCo-Founder & Chief Product OfficerBenekiva

Gina HardyChief Executive OfficerNorth Carolina Joint Underwriting Association

Anna Carina HäuslerDirector of Syncier MarketplaceSyncier

Tali MarienbergDirector and Chief Operating OfficerKlapton Insurance Company Limited

Cyndi EvansNational Account ExecutiveQuadient

Director, Business Development

TrustLayer

President

Toronto Insurance Women's Association (TIWA)

Darcy Shapiro

Head of Insurance for the Americas

Cover Genius

Liz Watson

Vice President

Crum & Forster

Lori Pon

Director, Claim Transformation

The Auto Club Group

Désirée Mettraux

CEO

OCC Assekuradeur GmbH

Anne-Laure Klein

COO and co-founder

Akur8

Lucile Beaurain

International Client Executive

Akur8

Director of Conversational Design Services

Interactions

Professional Standards Director

Chartered Insurance Institute (CII)

SVP, Marketing

iptiQ by Swiss Re

Assistant Vice President

iptiQ by Swiss Re

Event Schedule

Here is our event schedule

Registration and Networking

Getting Acquainted with the conference environment

Welcome Note by Altaworld

Opening remarks by Chairperson

Vinita Jajware-Beatty, President, Toronto Insurance Women's Association

Session Title: Newer Leadership Strategies and Insurance sector

Panel discussion: Changing Dynamics of Women leadership in insurance world

Moderator: Vinita Jajware-Beatty, President, Toronto Insurance Women's Association

Panellists:

Megan Duty, Vice President, Puritan Life

Tracey Sharis, SVP, Ironshore

Lizzie Bronte, Technology Delivery Leader, Nationwide

Gina Hardy, Chief Executive Officer, North Carolina Joint Underwriting Association

Brittany Nevins, Captive Insurance Economic Development Director, State of Vermont

Does your insurance coverage suffer from Imposter Cyber Syndrome?

Besides price, is there really a difference between the cyber coverage imbedded in the package policy vs. the stand alone cyber policy? Just because your policy includes the word “cyber” on the declarations page, does not mean that you have all of the extended coverage terms and limits to effectively protect your interests from a cyber related attack. Even stand alone policies differ from one insurer to the next. Make sure that you are insulating your risk by negotiating the most comprehensive terms available in the marketplace, because not all cyber policies are the same.

Jennifer Wilson, SVP, Cyber Practice Leader, Hub International

Are we there yet? Digital transformation is a journey, not a destination

Over the past two plus years, we have learned that the “new normal” for the insurance industry includes the ever-changing experience expectations. Meeting continuously changing needs means we need to change our approach, too.

• Rethinking who is the customer

• Embracing an agile focus on specific interactions

• Casting a wider net for the data that drives our priorities

Meredith Barnes-Cook, Vice President of Industry Groups, Ushur

Morning Refreshment & Networking

Session Title: Customer Engagement & Digital Era

Under Pressure: How Insurtechs Navigate Competing Demands

Industry buzz has disparaged InsurTech former-unicorns for rapid growth at the expense of sustainable operations. But there’s always more to the story. Straight from the “trenches," this session will present hard truths about founding, growing, and exiting an Insurtech. Not just for founders, this discussion is relevant to everyone in the innovation pipeline.

- balancing venture capital vs. the trap of perverse incentives

- build vs. buy for technology development

- tension between innovation vs. legacy: both systems and mindset

- the role of mission to drive alignment

Kate Stillwell, Founder and CEO, Jumpstart Insurance

Round table: Digitizing the customer experience for Future

Moderator: Vinita Jajware-Beatty, President, Toronto Insurance Women's Association

Panellists:

Manisha Dias, Head of Partnerships SCOR

Bobby Shrivastav, Co-founder & Chief Product Officer, Benekiva

Lilit Davtyan, CFO & EVP, Phonexa

Dora ClementsVP, Digital Transformation for Benefits, Contact Centers, and Enterprise Initiatives, UNUM

Priya Raghunatha, SVP, Digital Product Mgmt & Client Experience, Marsh Mclennan

Lunch and Networking Break

RegTech for InsurTech: Laws and Regulatory Oversight Impacting Our Industry

- A brief history of RegTech and the current landscape as it pertains to insurance

- Review market regulatory trends impacting insurance and setting the stage for RegTech solutions

- Learn considerations when building and deploying digitization and automation, including AI tools and ML models

- Recommendations for implementing a reg tech solution(s), including key takeaways to raise with your business to prepare for upcoming and inevitable regulation

Lori Welty, Senior Product Compliance Attorney, FINEOS

Leading Cross-functional teams to accelerate innovation

Disruption is the new norm. We are seeing traditional industries such as insurance and automotive undergoing a digital revolution with the proliferation of Big data sources such as the Internet of Things (IoT) and Connected Car to new frontiers such as autonomous vehicles. Today’s leaders developing innovative products are required to manage cross-functional and highly skilled multi-disciplinary teams composed of Product Managers, Data Scientists, Cloud Engineers, and UX/UI designers. In this workshop, you will learn about how to inspire and empower teams to thrive in a faced paced and disruptive environment.

Key Takeaways:

- Develop core competencies in developing AI-based product strategy

- Create a supportive environment for cross-functional teams to succeed

- Case studies from Insurtech to showcase how traditional industries are being transformed

Lakshmi Shalini, VP Risk & Insurance Analytics, Cambridge Mobile Telematics

Operationalizing Agile Machine Learning Product Teams

We shall discuss the key challenges facing an insurer in their AI/ML transformation journey. This will be followed by a discussion on how to overcome those challenges, including the required ML mindset, process, team and technological capabilities that can help accelerate an insurer's adoption of actionable ML-driven insights to support business decisions.

Zehra Cataltepe, CEO & Co-Founder, TAZI AI

Afternoon Refreshment & Networking

Connect the dots: Save Victims trapped by human trafficking

There’s a hope that pervasive evil of human trafficking may be thwarted by the innovations of disruptive technology. One goal is to create new communication pathways between industry and insurance.

Michelle Osborne, Associate Professor, Management & Chair of Business Administration, Campbell University School of Business

Power of Social Media for Agents

Social Media is continuing to be an important tool to building customer engagement, but what’s the best way optimize your social strategy? You’ll leave this session with a better understanding of the latest trends in social media and steps you can take to implement a effective program with your business. Key topics that we’ll discuss during this session include:

- Importance of implementing a top-down social-selling program and how it can drive business growth

- Social media trends to pay attention to

- The role community management plays in building loyalty

- Paid social – when and how

Kristi Daraban, Associate Vice President, Social Media, Nationwide

Kathyn Yun, Director, Social Media Enablement, Nationwide

Closing remarks by Chairperson

Networking & Drink receptiong

Day 1 – End of the Day Networking

Registration and Networking

Getting Acquainted with the conference environment

Welcome Note by Altaworld

Welcome Note by Chairperson

Session Title: Connected Insurance, Technology Disruptions & Data Analytics

Panel discussion: Digital Transformation Through Connected Insurance

Moderator: Susan C. Winkler, Executive Director Vice President, Connecticut Insurance and Financial Services (CT IFS), MetroHartford Alliance

Panellists:

Lauren Link, Director, Strategic Distribution, Kemper Auto

Lori Pon, Head Claim Strategy & Innovation, The Auto Club Group

Vinita Jajware-Beatty, President, Toronto Insurance Women's Association

Misha Bleymaier-Farrish, Founder, GSD Factor & Etymology Consulting

Panel Discussion: Insurance 2030 -The impact of AI on the future of insurance

Moderator: Sue Rickard, Vice President, Global CTO, Innovation Leader for Insurance, Cognizant

Panellists:

Janet D. Moylan, Senior Vice President, North America Underwriting Operations, Allied World Insurance

Deeksha Joshi, VP, GRS Strategy, Liberty Mutual Insurance

Katherine Wellman, Chief Product Officer, Cambridge Mobile Telematics

Allison Arzeno, CEO, Assurance IQ

Morning Refreshment & Networking

The secret ingredient to survive a digital transformation: Lessons Learned from Women in Insurance Tech

Laura Salazar, QA&T Talent Development and Innovation Manager, Softtek

Sue Rubin, Business Relationship Manager/ Account Manager, Softtek

Paloma Martínez GonzálezQA&V Talent Development & Engagement Leader, Softtek

Session Title: Process Automation: Claims, Underwriting, Customer Journey and more

Panel Discusion: How AI & automation help insurers deliver exceptional claims experience

Moderator: Danielle Gardiner, Senior Vice President, Lowers Forensics International

Panellists:

Michaele Clark, Client Relationship Director, Apex Claims Management

Georgette E Loizou, CEO, P&C Insurance System, Inc (PCIS)

Lunch & Networking Break

Using Technology and Insurance to Move the Energy Transition Forward

Moving the energy transition forward to combat the effects of climate change requires tremendous efforts from governments, private sectors and individuals. This section discusses how unique insurance products and underwriting approaches can be used to accelerate the adoption of meaningful technologies and create a more sustainable future.

Sherry Huang, Chief Actuary and Managing Director - Underwriting Development, New Energy Risk

How to Leverage on New Customer Engagement Models Capturing Untapped Revenue

Closing remarks by Chairperson

Day 2 – Networking Session

Get the detailed PDF agenda by replying to marketing@altaworld.tech

Sponsors & Partners 2022

GOLD SPONSORS

Request sponsorship brochure for 2022 at marketing@altaworld.tech

Past Sponsors and Exhibitors

Supporting Partners

Request Partnership brochure at marketing@altaworld.tech

Media Partners

Request to become a media partner on marketing@altaworld.tech

2020 Sponsors and Exhibitors

Request sponsorship brochure for 2021 at marketing@altaworld.tech

Event Venue

Hyatt Regency Boston

Discover the Heart of Downtown Boston

Explore Boston from our walkable downtown location. We’re near a cornucopia of attractions, restaurants, districts, and neighborhoods, including the Theater District and Chinatown. Hyatt Regency Boston also has a direct connection to the MBTA train.

Newsletter

Stay updated with latest speaker additions, agenda updates and ongoings of the conference.

Buy Tickets

Select a valid ticket option below as per your organisation category

Academic Access (Students)

$99

- Access to Live Sessions

- Lunch & Coffee Breaks

- Live Chat & Networking

- Paper Presentation

- Access Meetings Lounge

- 1-2-1 Meetings

Industry Access

$249

- Access to Live Sessions

- Lunch & Coffee Breaks

- Live Chat & Networking

- Paper Presentation

- Exhibition Area

- Access to Networking App

- Access to Meetings Lounge

Solution Provider Access

$499

- Access to Live Sessions

- Lunch & Coffee Breaks

- Live Chat & Networking

- Logo Branding

- 1-2-1 Meetings Lounge Access

- Accesss to Networking Area

- Early Accesss to Networking App

Contact Us

We'd love to hear from you! You can submit the form below or write directly to us on marketing@altaworld.tech

Latest News

Know What's Happening in the Insurance World

FRISS Partners With Eviid To Help Prevent Insurance Fraud By Authorizing Digital Media

FRISS, a prominent provider of AI inbuilt risk and fraud solutions declared their alliance with eviid, providing innovative evidential video technology to risk-conscious industries...

Insurtech firm INSTANDA brings up $19.5mn for global extension

The series A funding Round is taking the UK-based insurance entity INSTANDA to the next phase of its global extension. Read more...

Historic FinSec Regulation of New York to Cover DDoS

Starting today, New York’s banking and insurance sector need to report the authorities within 72 hours on any security incident that might have a ‘rational possibility’ of causing substantial harm...