About The Event

Transforming your insurance business has become a need of the hour!

New situations and scenarios have allowed insurance companies to break conventional barriers and start thinking differently to transform their businesses. The surge of InsurTech has opened up new business models, strategies, and cutting-edge technologies to leap onto the next step in your digital transformation journey.

Creating and delivering value in insurance has drastically changed, and the global pandemic only accelerated that change. All of the leading insurance companies have started to reimagine their businesses, both internally and externally, to meet the changing needs of their customers. These days, the only way to lead the market is by accelerating technology & digital transformations that can meet the needs of a world in crisis.

As insurance leaders have already ignited a new and different future—one predicated on technology, we, at Altaworld, constantly starve to create an alternate ecosystem built on technology innovations, digital transformation, and end-to-end connections.

To keep pace with the competition, insurance companies need to transform at a rapid speed. Not sure, how you can travel this transformation journey? Join our Insurance Tech Virtual Conference on December 7 - 8, 2021 inviting 30+ insurance technology experts to share their latest strategies, insights, solutions, and innovations to drive your insurance transformation journey!

Meet decision-makers from across the entire insurance value chain, with 200+ leaders from technology, innovation, data, analytics more.

Key Highlights

- New world, new customers, new solutions – Better customer experiences, Customer Engagement Models, Chatbots/Conversational Bots, Omni-Channel Support

- Digital Insurance Disruption - Leverage technologies such as analytics, blockchain and cloud

- AI/ML, IOT and Big Data in insurance

- Process Transformation – RPA, Legacy modernization, automated compliance and more

- Claims Transformation Roadmap & Virtual Claims Handling

Who Should Attend

The event will witness the perfect blend of leadership across the insurance sector who are looking to gain insights and wish to stay ahead in their digital transformation journey.

The attendee mix will observe CIOs, CTOs, CEOs, VP, Directors, Heads, and managers from the insurance domain including Brokers/agents, Retail agents, Claim Adjusters, Underwriters, Actuaries and more..

Speakers 2021

Speaker acquisition is ongoing! If you wish to participate as a speaker for the event, write to us on marketing@altaworld.tech

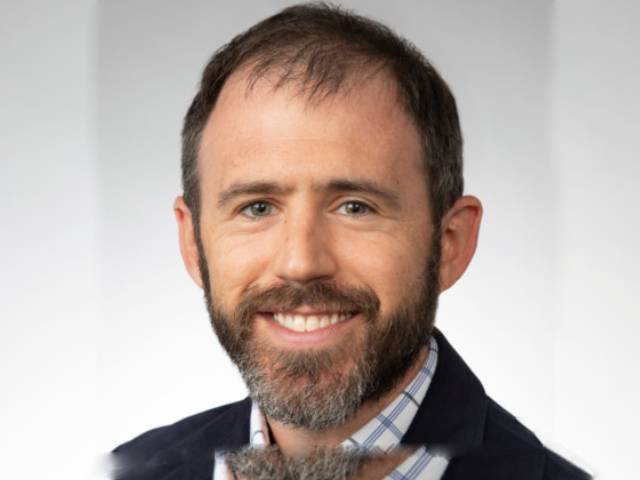

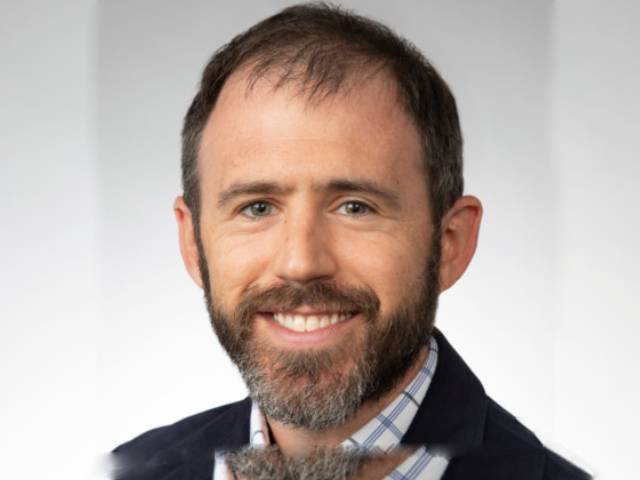

President

Toronto Insurance Women's Association (TIWA)

Meredith Barnes-CookGlobal Head of InsuranceUshur

Erik Jarrin PetersHead Specialy & Affinity RiskBarents Re

Satvinder KaurVice President - Operations & Digital Strategy - Communications & MarketingAcrisure

Jennifer Wilson

Director of Specialty Claims - Cyber Risk / EPL

HUB International

Lilit DavtyanCEO & CFOPhonexa

Megan DutyVice PresidentPuritan Life

Tali MarienbergDirector and Chief Operating OfficerKlapton Insurance Company Limited

David ConnollyPartnerErnst & Young

Erick MorazinSenior Vice-President Global TravelAXA Partners

Tracey SharisSVPIronshore

Alexandr LichySenior Product Manager, BaggageSITA

KV DipuPresident - Head Operations, Communities & Customer ServiceBajaj Allianz General Insurance

Jason PolayesDirector Product Management, Personal Auto UnderwritingVerisk

Head of Marketing and Technical Marketing

Discovery Insure

Speakers 2020

Speaker acquisition is ongoing! If you wish to participate as a speaker for the event, write to us on marketing@altaworld.tech

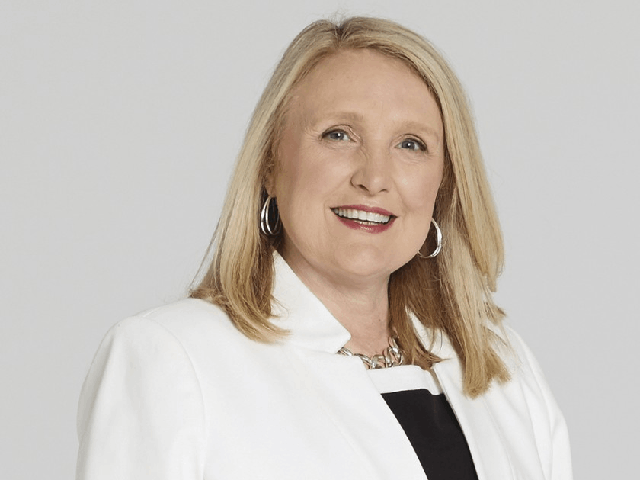

Lisa WardlawChief Financial Officer

Farmers Insurance

Donna JermerSVP, Marketing

iptiQ by Swiss Re

Dr. Robin Kiera

Founder

Digitalscouting

Emilio FigueroaChief Insurance OfficerForesight Risk and Insurance Services

Mark ReiderHead of InnovationNFP

Tracey SharisSVPIronshore

Michael CavanaughDirector of UnderwritingBoost Insurance

Mark A. JardinSenior Vice PresidentInsurance Program Managers Group

Monica Maria SanchezEVP Chief Information OfficerUnited Insurance Company

Rao TadepallCIOSeibels

KV DipuPresident - Head Operations, Communities & Customer ServiceBajaj Allianz General Insurance

Anne CoulombeHead of Data ProtectionMassMutual

Lori Pon

Director, Claim Transformation

The Auto Club Group

John Bodrozic

Co-Founder

HomeZada

Sebastian Dewhurst

Business Development

EASA Software

Vanessa Sammy

Head of Risk Transfer Strategy

Caresyntax

Erin WilsonEnterprise Business Development ManagerZipwhip

Mark Leonard EVP, Customer Success, Interactions

Sarah WileyGroup Vice President, Sound Physicians

Kerin Torpey Bashaw, Senior Vice President, The Doctors Company

Dustin YoderCEOSureify

ShawnMarie FrazierProgram Director & Domain Lead, Insurance and Financial IndustriesQuantiphi

Dawnmarie BlackRegional Director Northeast USLloyd’s

Douglas GahaganExecutive Vice President & PartnerAxon Underwriting, LLC

Meredith Barnes-CookHead of Global InsuranceUshur

Rekha SkantharajaPresident & CEOTangram Insurance

Meg McKeenFounder & Chief Confidence BuilderAdjunct Advisors LLC

Charles BlanchetVP of SolutionsICEYE

John FohrCEO & Co-founderTrustLayer

Vice President, Customer Advisory Services

Sureify

Assistant Vice President

iptiQ by Swiss Re

Event Schedule

Here is our event schedule

Agenda is subject to change, keep visiting this space for most updated event schedule!

Virtual Registration and Networking

Getting Acquainted with the virtual conference platform

Welcome Note by Altaworld

Opening remarks by Chairperson

Vinita Jajware-Beatty, President, Toronto Insurance Women's Association

Future of Insurance: 2030

Technology is enabling business capabilities for the insurance industry that before were not possible. EY has developed a set of predictions for insurance 2030, driven by the emerging InsurTechs, addressing areas including 1) The radiation of insurance into other industries such as automotive, fast food and commercial real estate, 2) The opportunity and threat for carriers associated with the formation of partner ecosystems to provide more holistic protection for customers across P&C personal and commercial lines, Life, Benefits and more, 3) The ability to provide a single premium price across multiple insurance products, 4) the need to re-price insurance risk every 10 seconds, 5) How carriers can become drivers of truly disruptive innovation, and 6) The structural shift required by both carriers and technology companies to be able to consume/produce micro-functions on demand to support the business.

David Connolly, Partner, Ernst & Young

Digitization & Customer Experience In the New Normal

- Digitization and CX are 2 side of coin

- How Digitization is helping organisation in Covid

- Digitization and Adoption of it to improve CX

- New CX in post Covid world

- How Bajaj Allianz is using technology in Digitization and CX

Dipu KV, President-Head Operations & Customer Service, Bajaj Allianz General Insurance

New dimensions of air travel data for boosting your insurance business

Find out how access to air travel tracking data from around the world can help in elevating your products to the next level. Automate the loss / delay detection, claims validation, pay-outs and more, all accelerated – based on data-driven decisions in real-time. Simplify the processes, cooperate with more airlines, and please your customers at the same time, easily.

Alexandr Lichy, Senior Product Manager, Baggage, SITA

Session Title: Assessing and Overcoming the Hurdles

Experimenting with the data and not afraid to Fail!

In the ever expanding world of user DATA, it is key to get, test the right data to see what really works. At the same time, there is so much noise with the tools that claim to solve the bigger data problems. Its critical to cut the clutter and learn with the tests to reach to the right audience and get qualified leads. Let’s explore what do you need to explore the data-driven Marketing campaign

Satvinder Kaur, Vice President-Operations & Digital Strategy, Acrisure

Networking Break

Panel Discussion: Reimagine the Future of Insurance

Join in a candid discussion among industry leaders as they reimagine the future of insurance, sharing their insights into the role technology will play in driving business outcomes, and maximizing the client, carrier and agent experience as they interact within the insurance ecosystem.

Moderator:

Vinita Jajware-Beatty, President, Toronto Insurance Women's Association

Panellists:

Erik Jarrin Peters, Head of Speciality & Affinity Risk, Barents Re

Erick Morazin, Senior Vice-President Global Travel, AXA Partners

Lori Pon, Director, Claim Transformation, The Auto Club Group

Jennifer Wilson, SVP, Director Risk Management Account Servicer, HUB International

Unlocking Transformation for Auto and Homeowners Insurance

Shifting demographics, increasing digital expectations, and rising competitive forces are transforming personal insurance. Using more data up front brings decision points forward in the workflow for better control of your underwriting and a great buying experience. In this presentation, we will showcase LightSpeed® for personal lines, which offers the potential for significant improvements in a wide range of processes such as bindable quotes in two minutes or less with just a name, address, and birthdate.

Jason Polayes, Director Product Management, Personal Auto Underwriting, Verisk

Having It All: Eliminating the Trade-offs Between Improving CX, OPEX, and EX

You can transform your customer experience while both reducing operating costs and improving employee engagement. And in a world of advancing consumer expectations, industry disruption, and The Great Resignation, this is a “must do” versus a “nice to have”. Let’s talk about how to avoid the temptation of doubling down only on customer experience while letting chips fall where they may from an employee experience and operating cost perspective.

Meredith Barnes-Cook, Global Head of Insurance, Ushur

Closing remarks by Chairperson

End of Conference & Open Networking

Virtual Registration and Networking

Getting Acquainted with the virtual conference platform

Welcome Note by Altaworld

Opening remarks by Chairperson

Vinita Jajware-Beatty, President, Toronto Insurance Women's Association

Session Title: Technological Disruption in the Insurance sector

Real-time risk insights by mastering emerging and disruptive technology

How can insurers attract talent and accelerate career pathing by upskilling and reskilling? What roles will insurtechs and other insurance technology play in this process?

This session will explore how insurtech and the incorporation of technology can help to address the “talent gap” insurers face.

Tracy Sharis, Senior Vice President, Ironshore

Disruption in Insurance – IRL

How can insurers make disruption more than just a buzz word? Join this session to explore a practical approach to innovation that can be applied in real life (IRL)

Megan Duty, Vice President, Puritan Life

Cyber Risk Claims – What You Need to Know BEFORE You Suffer a Cyber Breach

- Policy – making sure that the stand along cyber is endorsed to be primary over other cyber coverages automatically available with some package, crime and other policies

- Contractual risk transfer – review contracts to ensure that your coverage coincides with your contractual obligations; Make sure that the risk transfer is working in the right direction; Make sure policy endorsements include carve back for insd vs. insd

- Cyber event occurs – call hotline, get privacy counsel assigned immediately to establish confidentiality; be mindful of policy obligations: pre-approved breach counsel, IT forensics; PR firms; Notice to other insurers – make sure cyber standalone takes the lead

- Engage your broker – use broker as conduit between all carriers to ensure that claim is paid as the coverage was intended and negotiated

- Make sure that any contractual obligations are met – additional insured; indemnification; etc.

Jennifer Wilson,Director of Specialty Claims - Cyber Risk / EPL,HUB International

Building Strong Remote Teams

These days team members being physically distanced is becoming more of the norm. Whether in the same state or on the other side of the world, building collaborative teams is critical. Join this session for some practical tips and insights on how to build strong foundations for your virtual teams.

Jennifer Faria, AVP Product Owner, FM Global

Networking Break

Panel Discussion: How InsurTechs enable insurance value chain to deliver profitable and sustainable growth?

Moderator:

Vinita Jajware-Beatty, President, Toronto Insurance Women's Association

Panellists:

Lilit Davtyan, CEO & CFO, Phonexa

Meredith Barnes-Cook, Head of Global Insurance, Ushur

Precious Nduli, Head of Marketing and Technical Marketing, Discovery Insure

Closing remarks by Chairperson

End of Conference & Open Networking

Get the detailed PDF agenda by replying to marketing@altaworld.tech

Sponsors and Exhibitors 2021

Request sponsorship brochure for 2021 at marketing@altaworld.tech

GOLD SPONSOR

SPONSOR & EXHIBITORS

2020 Sponsors and Exhibitors

Request sponsorship brochure at marketing@altaworld.tech

Media Partners

Request to become a media partner on marketing@altaworld.tech

Supporting Partners

Previous Partners

F.A.Q

-

How do I register for a virtual event?

Register for the virtual event by selecting the Buy Ticket option from the right corner of the website. Select a category which applies to you and fill out the information required to register on the pop-up window. Once you click on Buy Now, you will be redirected to Eventbrite website to complete the payment.

-

When will I receive the instructions for attending the virtual event?

We are working diligently to prepare for this unique experience and will send you the necessary instructions within a couple of weeks of the event. Make sure that the email address associated with your registration is accurate and up to date so that there is no delay in receiving our communications.

-

How much does it cost to attend virtually?

The cost to register for the virtual conference is the same as the cost to register for the in-person conference. The cost to attend, however, is where you will see the potential savings. Consider that by attending virtually, you wont need to book travel and lodging accommodations.

-

Can my computer or mobile device handle the virtual event?

Most up to date computers and mobile devices such as laptops, desktops, and handheld tablets are capable of running the virtual event for you. We will share How to run your event by step by step process once you are registered for the event.

-

How can I ask questions during the conference?

During speaker sessions, we encourage you to ask questions at any time using public messages. You can also interact with individual speakers/attendees through private message option provided to each individual.

-

How can I access and view recordings of any sessions from the conference?

Your virtual conference registration includes access to all educational session recordings after the event concludes. Dont worry, you can view any sessions you missed out on as soon as the recordings for those sessions are made available through credentials provided to you. Note, however, that not all sessions are being recorded but those that are will be available for you to access at no additional charge.

Newsletter

Stay updated with latest speaker additions, agenda updates and ongoings of the conference.

Buy Tickets

Select a valid ticket option below as per your organisation category

Academic Access (Students)

- Virtual Sessions

- Coffee Break

- Live Chat & Networking

- Virtual Paper Presentation

- 1-2-1 Meetings

- Access Meetings Lounge

Industry Access

- Virtual Sessions

- Coffee Break

- Live Chat & Networking

- Virtual Paper Presentation

- Exhibition Area

- Access Meetings Lounge

Solution Provider Access

- Virtual Sessions

- Coffee Break

- Live Chat & Networking

- Logo Branding

- 1-2-1 Meetings Lounge Access

- Accesss to Networking Area

Contact Us

We'd love to hear from you! You can submit the form below or write directly to us on marketing@altaworld.tech

Latest News

Know What's Happening in the Insurance World

FRISS Partners With Eviid To Help Prevent Insurance Fraud By Authorizing Digital Media

FRISS, a prominent provider of AI inbuilt risk and fraud solutions declared their alliance with eviid, providing innovative evidential video technology to risk-conscious industries...

Insurtech firm INSTANDA brings up $19.5mn for global extension

The series A funding Round is taking the UK-based insurance entity INSTANDA to the next phase of its global extension. Read more...

Historic FinSec Regulation of New York to Cover DDoS

Starting today, New York’s banking and insurance sector need to report the authorities within 72 hours on any security incident that might have a ‘rational possibility’ of causing substantial harm...